What is the Gold-to-Silver ratio?

The best way to answer this question is by posing another question: how many ounces of silver are equal to one ounce of gold? Once you figure that out, then you’ve figured out the gold-to-silver ratio.

Also called the “mint ratio,” the gold-to-silver ratio represents the amount of silver ounces needed to equal 1 ounce of gold. This is also measured in price. For example, if 70 ounces of silver are equivalent to the price of 1 ounce of gold, then the ratio is 70-to1, or 7:1.

Why is the gold-to-silver ratio important?

The gold-to-silver ratio can help inform you whether the price of one metal is expensive or cheap relative to the other metal. So, if you’re wondering whether the price of gold is too high or too low relative to silver, and vice versa, the gold-to-silver ratio can help you make that assessment.

But too high or too low relative to what?

This is where things get a bit fuzzy; where interpreting the gold-to-silver ratio is more of an art than a science.

You might base it on a starting ratio of some sort but that may be too inflexible. For instance, in 1792, the US government set the starting ratio to 15:1, or 15 ounces of silver to 1 ounce of gold. We haven’t seen that equivalence in well over a century.

You might also base it on a historical average. Averages also change, but it changes slowly over a long period of time.

Ok, I’m sort of getting it. But can you give me a brief history of the ratio so I can get a clearer picture?

No problem.

In Ancient Rome circa 210 BCE, Roman civilization saw 8 ounces of silver equivalent to 1 ounce fo gold. So, their gold-to-silver ratio was set at 8:1 or 8 oz silver to 1 oz gold.

Fast forward a couple of centuries and in 46 BCE, Julius Caeser decided that 11 and a half ounces of silver—an 11.5:1—was more suitable. Gold inflows from Roman conquests caused the ratio to fluctuate, requiring occasional resets.

But Rome wasn’t the only civilization using gold and silver. Empires across the Middle East and Asia also used the metals for monetary purposes. In some cases, they even valued silver more so than gold. This means that the ratio was likely to be lower.

Wasn’t the gold-to-silver ratio fixed at some point?

Off and on, yes, but a real effort toward fixing it on an international scale didn’t really take place until two millennia later. In the US, the Coinage Act of 1792 fixed the ratio to 15:1, or 15 ounces of silver to 1 ounce of gold. Most of Continental Europe and Britain held similar ratios. But the California Gold Rush, the Industrial Revolution, and the two Worlds Wars would change all of that.

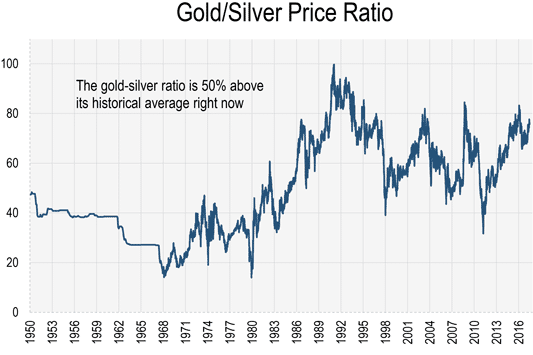

In the 20th century, we saw the ratio average around 40:1 and reach as high as 100:1 during WWII. So, fixed or not, “in flux” seems to be the ratio’s natural state. Yet relative flux can still have its extremes, such as what happened in 2020 at the onset of the global pandemic.

Didn’t the gold-to-silver ratio reached a crazy 5,000 year high?

In 2020, the gold-to-silver ratio hit an all-time high of 123:1. Since this level was a first, we can assume that it marked an astounding 5,000 year high. The pandemic contributed to the widening of this short-lived spread between the two metals. Apparently, many investors bought a lot of gold but sold their silver.

What happened after the ratio hit this new record high?

Gold still made its way higher, but silver skyrocketed, outperforming almost every other asset in 2020. As a hybrid monetary and industrial metal, silver’s monetary value was severely discounted. Investors who saw this wide spread as a temporary imbalance and fleeting opportunity likely benefitted from understanding the history of the gold-to-silver ratio.

This brings us to another important question…

How might someone interpret the gold-to-silver ratio?

In a nutshell…

- When the ratio rises, gold is outperforming silver. If you feel the ratio is overextended to the upside and expect it to fall, then you might anticipate silver to outperform gold whether the metals are rising or falling.

- When the ratio falls, silver is outperforming gold. If you feel the ratio is overextended to the downside and expect it to rise, then you might anticipate gold to outperform silver whether the metals are rising or falling.

We admit, this is a lot to wrap your head around especially if you're just now getting familiar with this indicator. To wrap it up and provide you with a comprehensive view of the history of this ratio, here’s an image of the ratio’s 200-year history.