Why Buy Silver Coins from GSI Exchange?

At GSI Exchange, we carefully monitor trending markets for Silver coins and Silver bullion offering the highest promise and utmost value for our customers looking to buy Silver or fund a Silver IRA.

-

Silver Bullet - .45 Caliber -1 oz

-

Silver Morgan Dollar 1883-CC GSA NGC MS65

-

2 oz British Silver Queen’s Beast White Greyhound Richmond 2021 Coin

-

2 oz British Silver Queen’s Beast (Random Year) Coin

-

2019 2 oz British Silver Queen’s Beast Falcon Coin

-

2016 Silver Great Britain Queen's Beasts (The Lion) - 2 oz

-

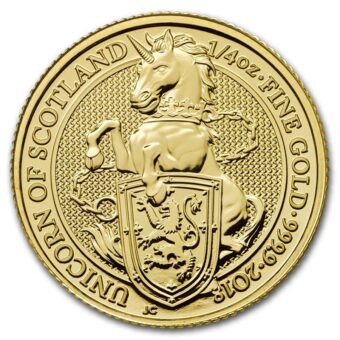

2018 1/4 oz Great Britain Queen's Beast Gold Coin - Unicorn

-

2017 1/2 oz Australia Silver Lunar Rooster BU - Series II

-

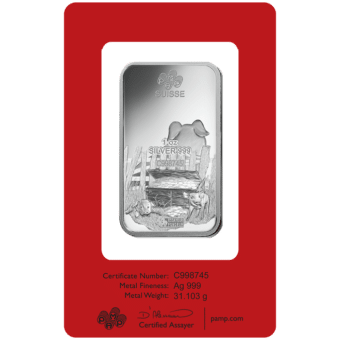

PAMP Suisse 1 oz Lunar PIG .999 Silver Bar

-

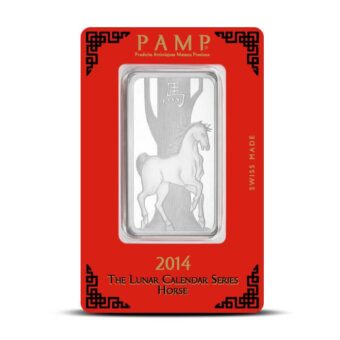

PAMP Suisse 1 oz Lunar HORSE .999 Silver Bar

-

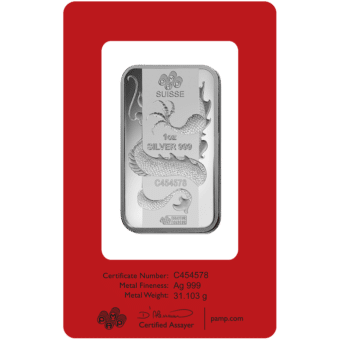

PAMP Suisse 1 oz Lunar DRAGON .999 Silver Bar

-

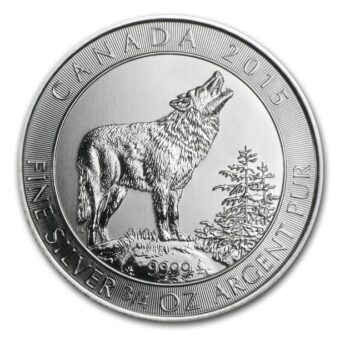

2015 3/4 oz Canadian Grey Wolf Silver Coin

Purchasing Silver

Buying Silver mining stocks or holding a fund that holds Silver bullion are popular ways for asset owners to get Silver exposure. Although these investment vehicles do present certain advantages, particularly when stock markets are rising, they also present risks that are not correlated with the yellow metal.

For instance, Silver mining stock prices may be correlated to the price of spot Silver. But stock prices are also sensitive to the valuations of the mining company that offers them. Should a mining company underperform relative to the industry average, its stock value will depreciate, effectively removing its correlation with spot Silver.

On the other hand, funds that hold Silver bullion may charge fees for management and performance. Any additional fees paid to an intermediary can erode profits when Silver appreciates and add to losses when Silver fluctuates to the downside.

The primary goal of buyers who use these financial instruments is to add Silver exposure to their portfolios. In light of this goal, it might make better sense to bypass these additional risks and fees, opting instead to buy Silver online as a financial strategy.